Your cart is currently empty!

RED ALERT | Green Impact Exchange – an incremental approach to trading nature on Wall Street

Activist investors and Wall Street tycoons have their eyes on our public lands, and the Biden administration is giving them what they want. They are working in parallel with environmental interests, politicians, and the media to completely consolidate control over “all things that make life on earth possible.” The people must respond in overwhelming opposition to this tyrannical corporate takeover of our public and private lands.

The Securities and Exchange Commission is asking for public comments on whether to approve or deny an application by the Green Impact Exchange LLC to register as a National Securities Exchange. If approved, the Green Impact Exchange (GIX) will be the first securities exchange in the U.S. dedicated to funding the green agenda. Similar to the New York Stock Exchange, the Green Impact Exchange will list corporations and allow investors to buy and sell stocks, bonds, and other green financial assets relating to sustainable development and ESG.

According to the SEC filing in the Federal Register, the fully automated exchange uses software designed and owned by Members Exchange (MEMX), who will enter into agreements to license the technology powering the Green Impact Exchange. MEMX will retain ownership of the core technology, while GIX is granted usage rights through the licensing agreement. MEMX is a member exchange with BlackRock as one of the core partners.

According to the Form 1 application filed with the SEC, the Green Impact Exchange is dominated by four major billionaire shareholders: CEO, financial services litigator, and prosecutor at the NYSE, regulatory auditor, and consultant Daniel Labovitz; American billionaire businessman and entertainment titan Charles Dolan; Director of Freedom Holding Corp., a Nasdaq-listed financial services company headquartered in Kazakhstan and accused of fraudulent practices, Timur Turlov; and a mysterious individual named Arif Kuzhukeyev, with no information available online.

A Future for Trading Nature Within the ESG Framework

The digital exchange centers its operations on the Environment, Social, Governance (ESG) framework, claiming to attract institutional investors interested in sustainable development initiatives. Pioneered by BlackRock, the ESG standard considers things like environmental impact and social responsibility as financial risks that must be disclosed to investors. The SEC now requires ESG disclosures for the vast majority of publicly traded corporations, and to appease investors, corporations are now publicly announcing their alignment with the Paris Climate Agreement and injecting themselves into social issues.

The criteria defining entities eligible to list on the Green Impact Exchange inherently qualifies ESG-driven corporations. Under this proposal, an incremental approach is taken to trading stocks and bonds connected to environmental organizations on Wall Street. Entities that own the rights to nature, such as under the new BLM Conservation Lease Rule, would qualify without the need to change the New York Stock Exchange Listed Company Manual as proposed in October of 2023. Instead, the Green Impact Exchange would fit like a glove, with entities similar to Natural Asset Corporations naturally meeting every standard.

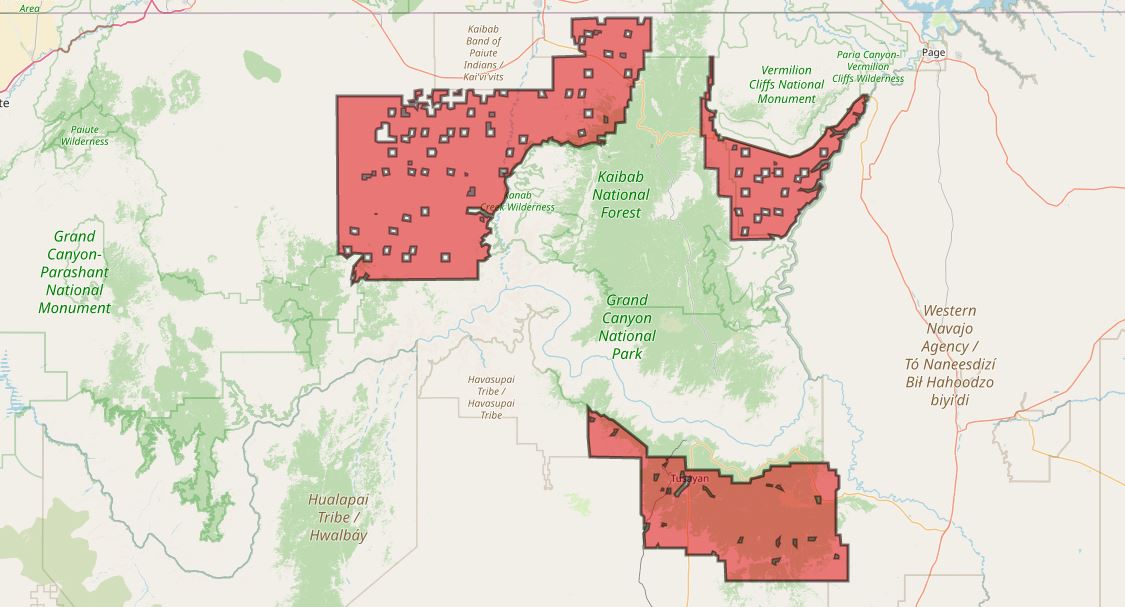

The Natural Asset Corporation scheme, withdrawn earlier this year by the SEC because of massive backlash, could emerge as a future listing entity on the Green Impact Exchange. Natural Asset Corporations are businesses established by landowners, governments, nonprofit organizations, and corporations that own the performance rights to ecosystems. Their main function is to convert natural processes (ecosystem services) like pollination and precipitation into financial assets that can be bought and sold on the financial market. Not only do they deal with natural processes, but also with other benefits that nature provides humans, like natural resources, timber, recreation, and restoration. These corporations assume the rights to natural processes through agreements with the government and private entities. On public lands, these entities gain control of ecosystem services through various agreements with the US Forest Service, National Park Service, Bureau of Land Management, and others relating to guided tours, restoration, management, and conservation.

The Form 1 application by the Green Impact Exchange details the guidelines corporations must meet to list on the exchange. To list on the Green Impact Exchange, corporations must already be listed on another exchange and adhere to specific Green Governance Standards designed to ensure corporations are adhering to sustainable development goals under the Paris Climate Agreement and others. The Green Impact Exchange will be a dual-listing venue. Therefore, what companies can list on the venue is limited. However, according to the Green Impact Exchange FAQ section on their website, this will soon change, allowing any company that meets their standards to list on the exchange as their primary venue.

To list on the Green Impact Exchange, companies are required to establish board governance policies that reinforce their “Green Goals,” which include adopting a Green Values statement, appointing a Chief Sustainability Officer, and implementing a generally accepted sustainability reporting framework. These frameworks may include various globalist third-party standards, such as the Task Force for Climate-related Financial Disclosures and the Global Reporting Initiative. Additionally, corporations must conduct stakeholder analysis to identify and classify stakeholders affected by their environmental practices and publish these findings in their sustainability reports.

Furthermore, listed companies must articulate clear short-, medium-, and long-term environmental goals and provide a Green Business Plan outlining resources, responsibilities, and timelines for achieving these objectives. Annual self-evaluations of progress toward Green Goals must be disclosed, including metrics used to measure success based on the selected sustainability reporting framework designed by globalist and environmental interests.

A Greenwashed Scheme to Consolidate Control Over Nature

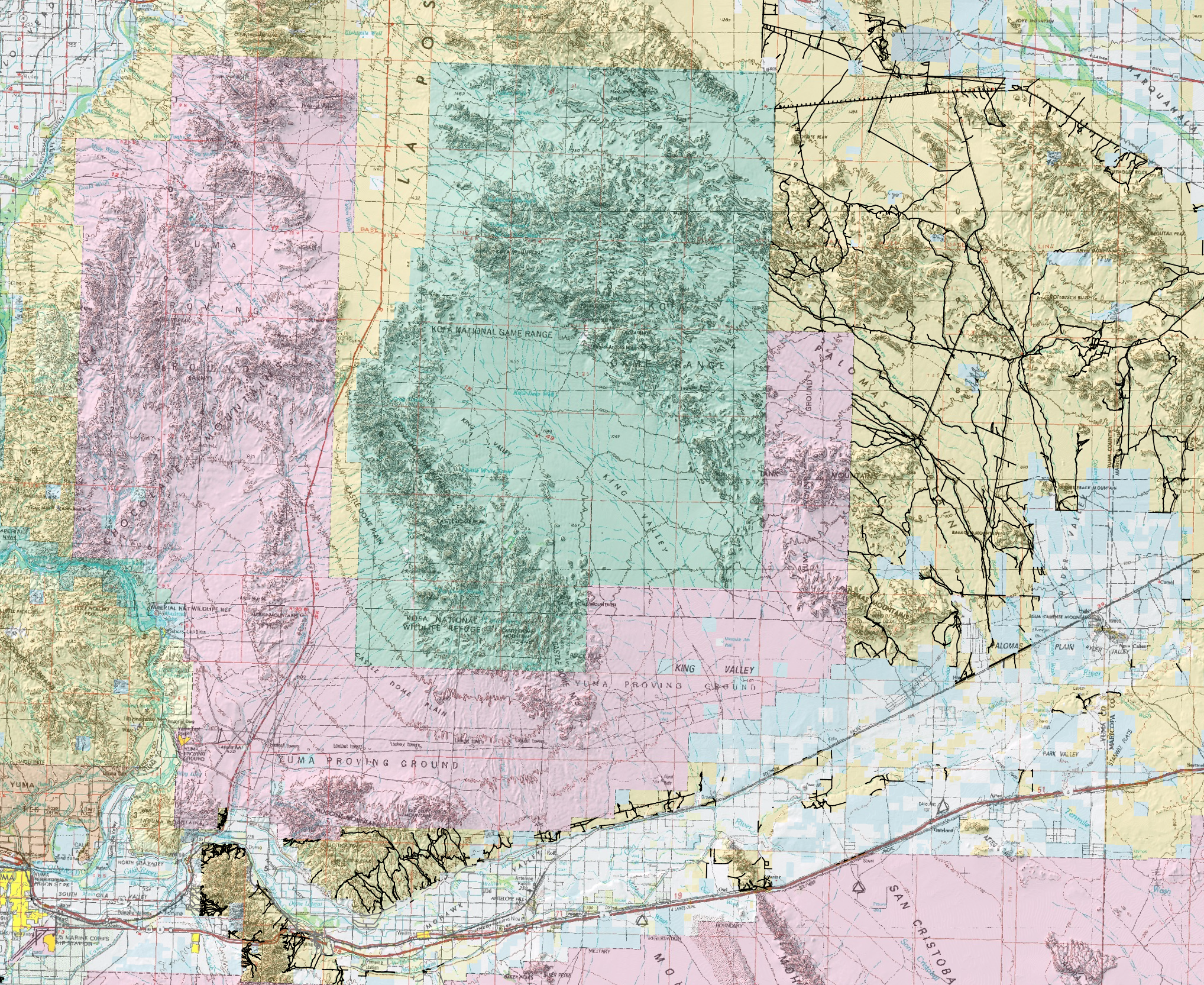

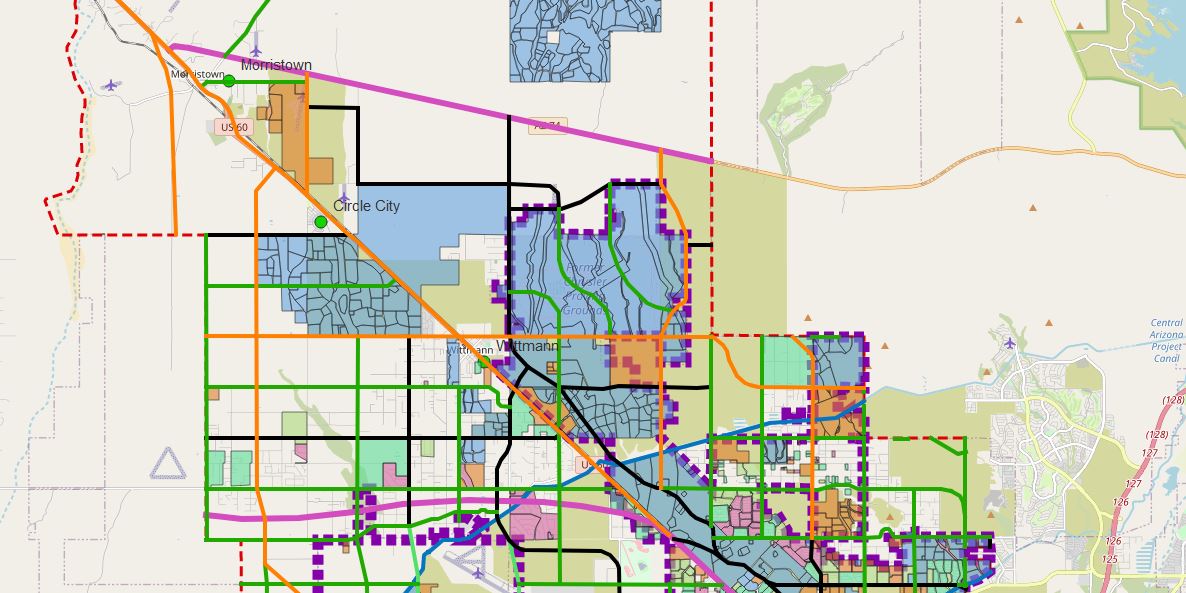

During the Biden-Harris administration, multiple transformative policies were implemented that handed control of our public and private lands to corporate entities dominated by institutional investors from all over the world. These corporate entities have acquired massive federal grants and are involved in restoration projects, logging companies, biomass energy, lumber mills, eco-tourism, recreation site management, and other projects on federal lands.

Federal agencies like the Bureau of Land Management, National Park Service, and the US Forest Service are incorporating policies to leverage corporate investment funds to complete management projects like Travel Management. This allows the executive offices of the federal government to become independent from our representatives in Washington, DC, and introduces massive corporate influence over management decisions on federal lands. By investing in these projects, corporations and investors can increase returns on their investments by bolstering ecosystem services, thereby increasing values. This implementation of the System of Environmental Economic Accounting in the United States will create a mechanism for foreign interests to control our natural resources that cannot be challenged.

To learn more about this corporate takeover of public lands, read this special report.

Find the SEC federal register listing here

Find the SEC Green Impact Exchange Application here.

Send your comments to the SEC using the form below.

Comment on the GIX form 1 Application

Tags:

We Need Your Help To Keep Our Backroads Open!

Please become a member today!